25.19 – Notice of Appraised Value Explained

Welcome to the Williamson Central Appraisal District Notice of Appraised Value explanations page. Here, we hope to help you understand what this notice means to you, your responsibilities as a property owner and provide some guidance on the process of protesting.

Where should you begin?

Click the + symbols below to expand the question and get more info related to the notice.

- Per the Texas Property Tax Code, the chief appraiser shall deliver a clear and understandable written notice to a property owner of the appraised value of the property.

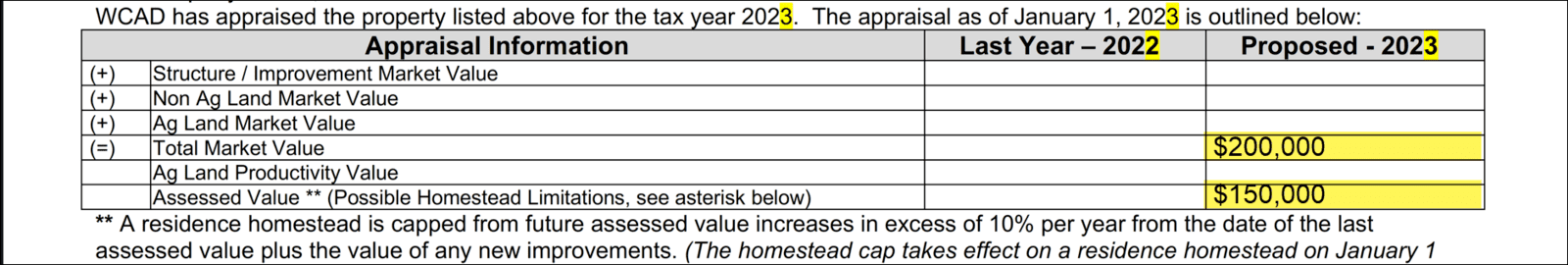

- Your Notice of Appraised Value indicates the appraised value of your property, as of January 1st, for property tax purposes. The ASSESSED value is the value that will be used by Williamson County Tax Assessor to calculate your property taxes.

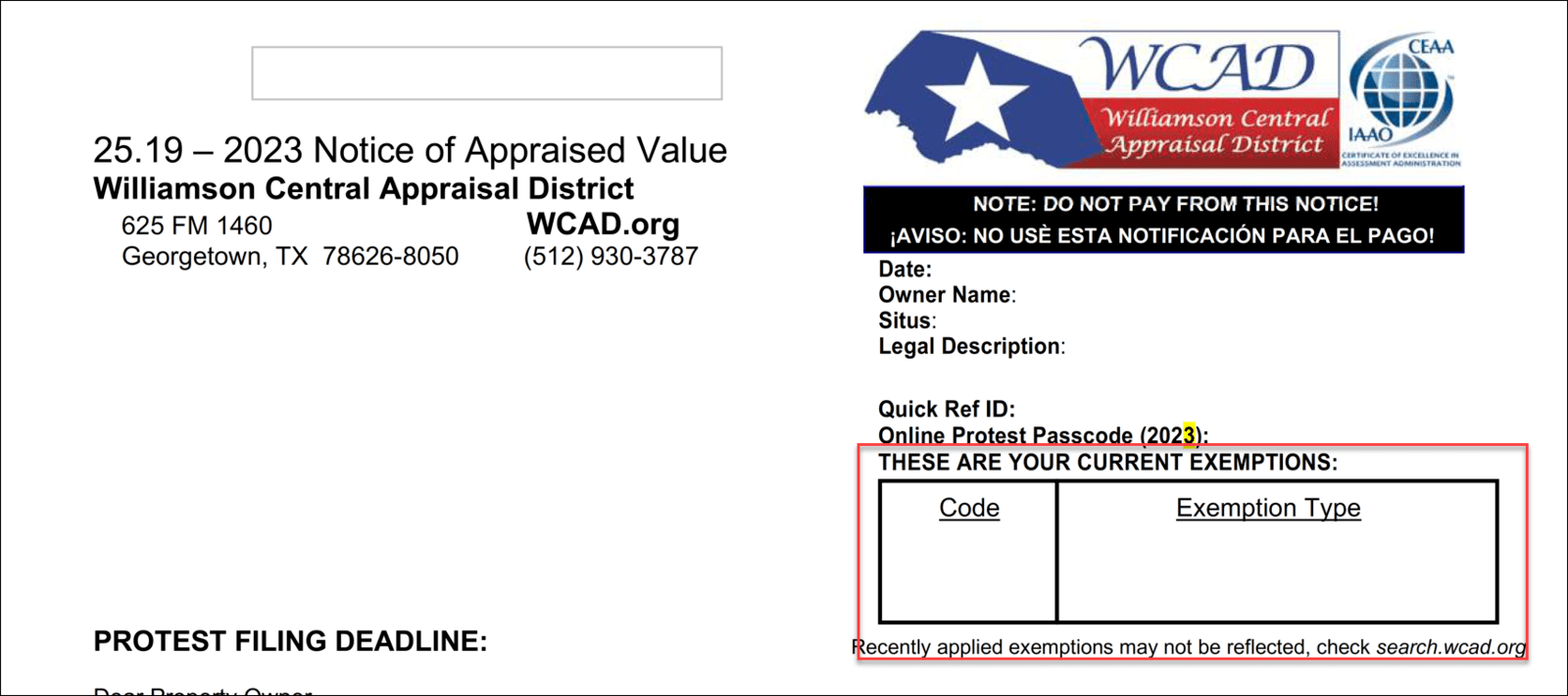

- Verify your information is correct, such as owner name, property details, mailing address and the exemptions on the property (Exemptions applied for in the last 6-8 weeks will not be reflected).

- Review the appraised market value. If you do not agree with the market value, you can file a protest (free of charge), before the protest deadline. Instructions are provided here and included in your Notice of Appraised Value.

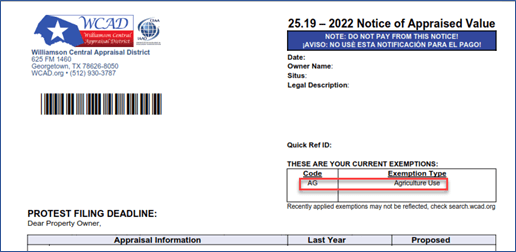

You can find current exemption information near the top, right corner of your notice.

Please be advised that Exemptions applied for after Jan 15th, 2023, may not reflect on your notice but may have been/will be processed within the 6-8 week timeframe and reflected on our website.

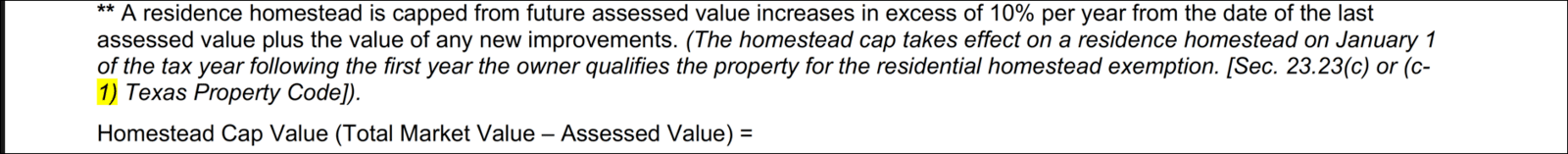

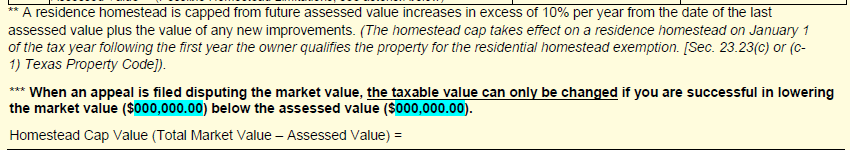

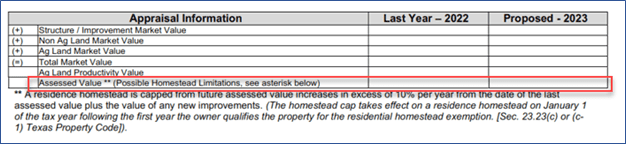

Cap info can be found on your notice, right under the grid containing values. Homestead caps are granted after the first full calendar year (January 1- December 31) you have owned and occupied your residence. Example, you moved into your home on March 3rd, 2022, you will be eligible for the Homestead cap beginning January 1, 2024.

More information about the cap is located on your Appraisal Notice, including a formula illustrating how the cap is calculated.

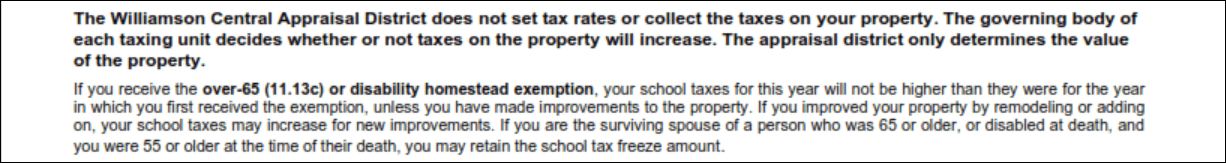

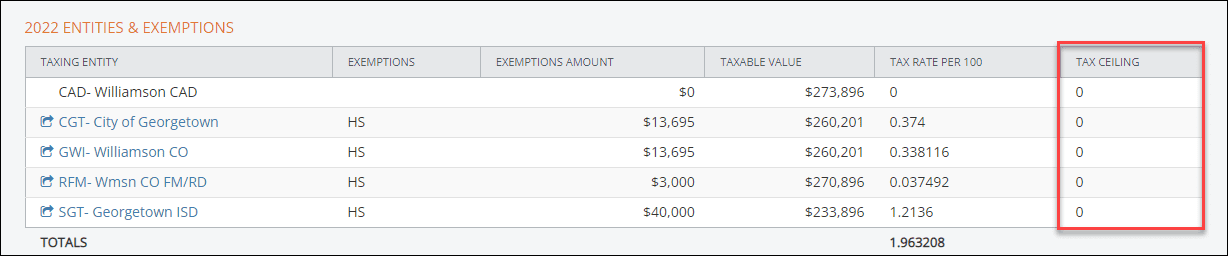

These exemptions create a tax ceiling for your tax dollar amount paid. This does NOT freeze your Market or Assessed value. These Tax ceilings are not affected by market value increases (unless there is a new improvement, etc.)

You can check your freeze amounts on your property details page available by using our property search at https://search.wcad.org.

Look for the Entities & Exemptions portion of the page:

Market value- Per the Texas Property Tax Code, all taxable property must be valued at 100% of market value as of January 1 each year.

Assessed value- the reduced value of your property based on the limitations provided by having a Homestead Exemption cap. Per the Texas Property Tax Code, an exemption for taxation is available to an individual’s primary residence. One of the features of the exemption is a limit to the amount that the value for taxation can increase from one year to the next. This limit is frequently referred to as the “homestead cap”. The “capped” value is shown as the “Assessed Value” and is located at the bottom of the list of values on your notice or online. The assessed value IS limited by the Homestead Exemption and may not go up more than 10% in one year in most cases as long as the exemption was in place for the prior year for the current owner.

There are many factors to consider when deciding to file a protest:

- What value are you protesting?

- Market value is the only value that can be protested

- Do you have evidence to support your opinion of value?

- Sales of properties comparable to yours can be obtained from a local realtor.

- Do you have an Over 65 or Disabled Person Exemption?

- If you have either of these exemptions, you may have a Tax Ceiling on the TAX DOLLAR AMOUNT fr ISD, Williamson County, FM/RD. An increase of Market Value or Assessed Values will not affect these Tax Ceilings, unless you have made improvements to the property.

- If you are protesting an exemption status or denial, familiarize yourself with the necessary qualifications.

- Visit the exemptions area of our Knowledge Base for more information.

The protest deadline is May 15th, 2023.

Filing a protest is free and can be done three different ways: Online, Mail, or In Person

The best way to file a protest is to use our online appeal system. Online protests may qualify for early hearing scheduling.

- Access the www.wcad.org website prior to the indicated Protest Filing Deadline. Using your Quick Ref ID & Online Protest Passcode, select the ONLINE PROTESTS tab near the top of the page (further instruction included on our website).

- If you are unable to resolve your protest online, the ARB will mail you notification at least 15 days prior of the date, time, and place of your informal/formal hearing.

Keep in mind, the online appeal system is set up for protests related to market value. A protest for any other reason can be filed by submitting the form included in the envelope with your Notice of Appraised Value and returning to WCAD in the postage paid envelope, also included in your Notice packet.

[Insert info/link to more info about protest form, etc.] (RES Review)

Once a protest is filed with our office, you will be scheduled for a formal hearing before the ARB and will be sent a Notice of Hearing at least 15 days before your scheduled hearing date. You will have the opportunity to meet with an appraiser the day of your scheduled hearing to discuss value, get more information, and possibly come to an agreement without needing to go before the ARB. However, if you cannot come to an agreement with the appraiser, you will have the opportunity to go before the ARB and present your evidence and get a final determination from them.

For productive review tips, including examples of documentation to bring, please visit: http://www.wcad.org/protest-procedures

Agricultural Valuation

When viewing the top section (header) of 25.19 - Notice of Appraised Value locate the box titled “THESE ARE YOUR CURRENT EXEMPTIONS. “ In the box below labeled Code you will find each exemption associated with your property. If your land is receiving the AG Valuation, the letters “AG” will be located in that box along with the description “Agricultural Use” under Exemption Type.

Ag applications are processed in the order they are received. The Texas Property Tax Code allows a 90-day application processing window. Once your application has been processed you will receive a determination letter in the mail.

Production values can fluctuate annually and usually differ between agricultural uses. These values are calculated using a 5-year rolling average that considers the typical production income less expenses.

If the property owner does not agree with the Market Value of the Improvements and Non-Ag Land, a protest may be warranted. The property owner should submit evidence opposing those Market Values. Please note, any changes to the Market Value of AG Land will not result in a lower Assessed Value.